What we offer

CU Button powers Credit Unions to automate their loan underwriting - accelerating decision times, reducing the amount of manual intervention & subjectivity, while increasing the level of control & transparency. CU Button automatically analyses Credit Union members current accounts and categorises their transactions to feed into the members’ creditworthiness assessment.

Using a predefined set of rules such as the Insolvency Service Ireland Affordability Guidelines along with Credit Union specific tailoring, the platform calculates a repayment capacity and supports the loan officer to understand the risk profile and credit eligibility of a member or members.

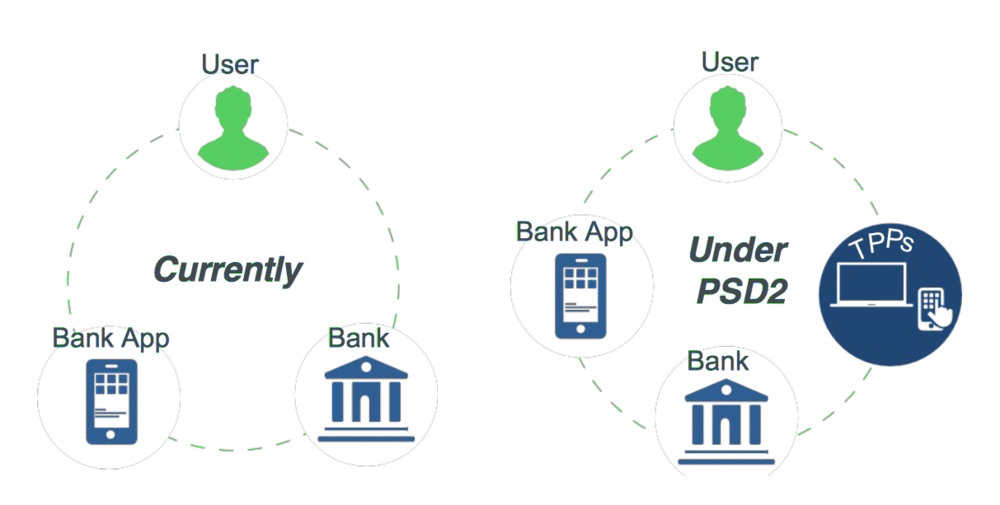

The platform is fully PSD2 ready - meaning the integration with accounts across all financial institutions is seamless. With PSD2, Credit Unions can boost their member experience by connecting directly to their members' information, thereby driving more accurate & timely eligibility and engagement.

CU Button enables multi-channel access to this digital underwriting capability - allowing rapid in-person or online decision making & information capture, direct online member engagement and channel partner engagement (such as car finance on forecourts).